Fatma is a management consultant with a background in Statistics. Being involved in advisory and strategy, she understands the importance of investing and growing her wealth. However, as a person who values adherence to Islamic principles, Fatma struggled to find investment options in Kenya that aligned with her beliefs due to the presence of interest-based transactions. That’s when she discovered ndovu, a digital savings and investment platform offering a Halal investment solution.

Discovering ndovu’s Shariah-complaint Investment Solution.

In 2020, Fatma stumbled upon an Instagram ad promoting Halal investing, which immediately caught her attention. Having heard the advice to start investing early, she was intrigued by the possibility of investing in a way that met her ethical requirements. Intrigued by Ndovu’s proposition, she researched further and relied on their website to learn more about their offerings.

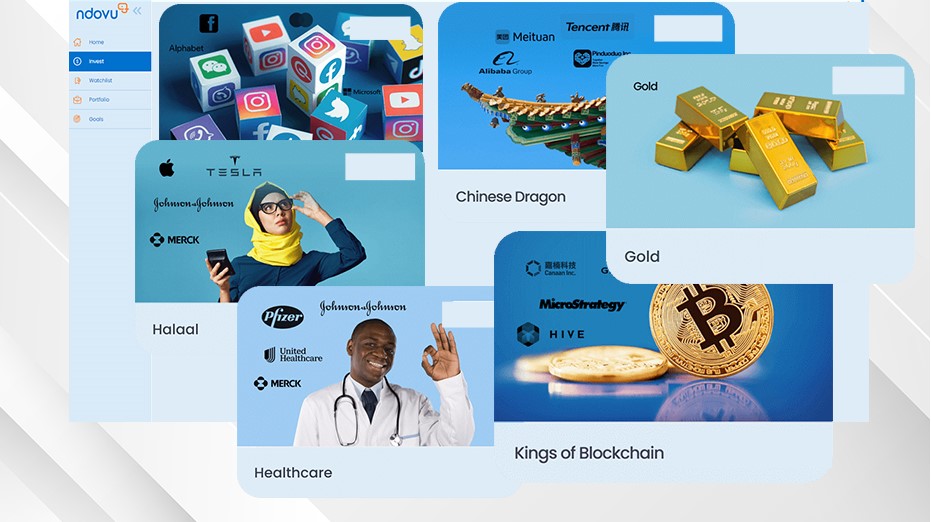

What set ndovu apart from its competitors for Fatma was the availability of a dedicated Halal fund. This unique offering allowed her to invest while staying true to Islamic principles.

ndovu has assisted Fatma in growing her wealth and helped her budget effectively. She better understood her expenses through the platform’s resources and tools and could allocate her funds more efficiently, even regarding her passion for food and dining out.

Experiencing Gains from ndovu’s Win-Win Investment- the Halal fund.

Fatma was actively seeking a solution that would allow her to grow her wealth without compromising her values. High inflation rates made her realize that keeping her money in a savings account was causing it to depreciate. She wanted her investments to align with Islamic principles and sought a Halal investment avenue that offered the potential for good returns.

Fatma chose ndovu’s Halal index fund as her tailored Halal investment option. The Halal Fund let her invest ethically and profit from market opportunities.

Investing with Confidence.

Fatma gained a wealth of financial knowledge in the short term through ndovu. The platform’s numerous workshops, webinars, and free financial advisory sessions have significantly improved her financial literacy. As for the long term, Fatma remains optimistic about the outcomes of her investments and looks forward to seeing her wealth grow.

“I encourage those hesitant about investing to start small, with as little as Kshs 7,500 on ndovu. I advise potential investors to take advantage of ndovu’s free financial advisory sessions, which provide valuable guidance and assistance in understanding the company, initiating investments, and setting personalized financial goals.”

Fatma.

Fatma’s Future Investment Plans

Looking ahead to her 2023 investment plan, Fatma intends to invest more money and eagerly awaits the introduction of additional Halal products and services from ndovu. She plans to continue her journey with ndovu and explore new opportunities for growth while adhering to her ethical principles.

Fatma Noor’s experience showcases the value of ndovu’s Halal Fund in empowering individuals to pursue financial growth through ethical and Shariah-compliant investments. Sign up on ndovu today and stay true to your faith and beliefs throughout your financial journey.

Disclaimer: All ETF products are subject to risk, including country/regional, liquidity, and currency risks. Market prices of securities within the ETF may rise and fall, sometimes rapidly and unpredictably.

While ETFs provide diversification through exposure to a basket of securities, they do not eliminate the risk of loss. Diversification does not ensure a profit or protect against a loss. These are non-CIS products registered by the SEC.