Are you looking for a safe and convenient way to grow your savings in Kenya? Have you heard of money market funds but need clarification on what they are and how they work? Look no further!

In this blog post, we’ll explore the world of money market funds in Kenya and why they continue to become an increasingly important investment vehicle for new and experienced investors.

So, let’s start with the basics. What is a money market fund?

Simply put, a Money Market Fund (MMF) is a mutual fund that invests in different low-risk, short-term asset classes. These asset classes include:

- Commercial Paper – These are short-term debt instruments corporations issue to finance their short-term cash flow needs.

- Treasury bills (T-bills) – These are paperless short-term borrowing instruments issued by the Government through the Central Bank of Kenya to raise money on a short-term basis

- Fixed deposits – These are financial instruments banks offer that give investors a higher interest rate than a regular savings account until maturity.

Professional fund managers oversee these funds and aim to provide investors with stable investment returns while preserving their capital.

How Do Money Market Funds Work?

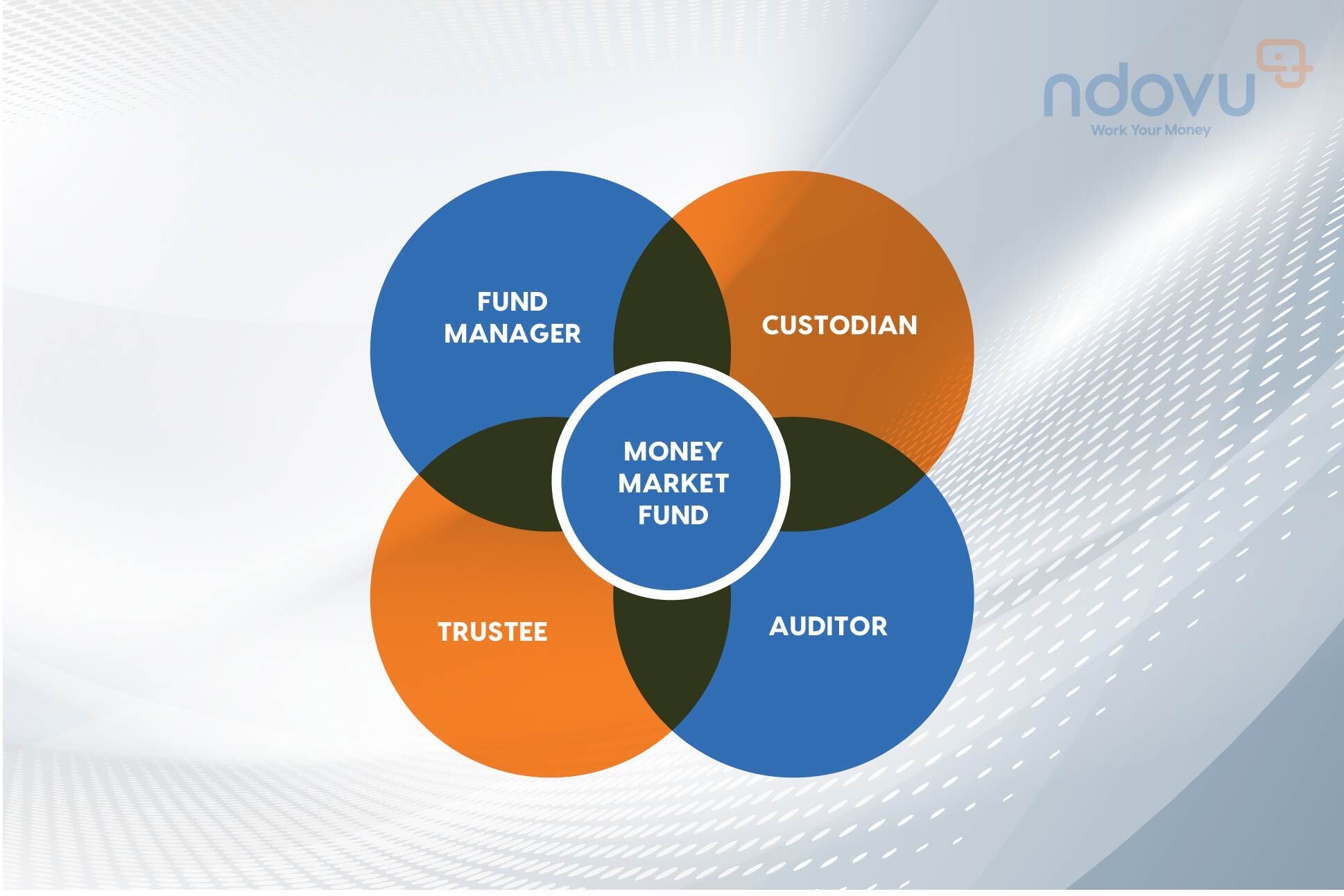

Four different parties are involved in the ecosystem of a money market fund: a fund manager, a custodian, a trustee, and an auditor.

The Fund Manager: The Capital Markets Authority licenses and regulates this registered company. The fund manager creates an investment portfolio and makes investments on behalf of its investors.

The Custodian: A custodian, often a bank, keeps the money on behalf of investors until the fund’s management makes an investment choice. The custodian then releases the investment amount per the fund policy.

The Trustee: The trustee ensures that the custodian and fund manager are held responsible for the decisions made surrounding the fund. They watch for financial misconduct and act as the MMFs’ watchdogs.

The Auditor: The auditor reviews the fund’s financial statements; investors then use these to assess how the MMF performs.

Because of their extensive oversight, MMFs are considered a low-risk investment option. It is, however, essential to consider the identities of the various service providers before choosing which MMF to invest in.

Why Should You Invest In Money Market Funds?

Like any investment, money market funds have different benefits and drawbacks. As an investor, it is crucial to understand the two to decide whether they are right for you. So why invest in MMFs?

1. Easy accessibility.

One significant advantage of MMFs is that you can easily access your money. Transactions are hassle-free if they are within your account’s transaction limit. As a result, a money market account is one of the most suitable places for stashing your emergency funds. On average, you can access funds within three working days.

2. Higher interest rates

As an investor, you can earn considerably more elevated amounts of interest with a money market fund than you would with a regular savings account. MMFs also allow members to reinvest their interests to profit from compound interest.

3. Low-Risk and Safe Investment

A money market fund is considered one of the safest investments available and is an excellent tool for protecting your investment while making money at a lower risk.

4. Transparent

Tracking the fund and its earnings is simple.

Risks Associated With Investing In Money Market Funds

Investments are not government-insured

The Kenya Deposit Insurance Corporation (KDIC) does not insure the money you save on MMFs. In the case of mismanagement, the absence of coverage eliminates the risk of losing your money, even though MMFs generally entail low risk.

Returns are not constant.

The returns a money market fund manager makes determine how much interest you earn. If a fund manager registers low returns, you will earn low returns.

Returns may not beat inflation.

Although high returns are possible, they are more prone to inflation risk because returns on MMFs come at a lower rate than other riskier investments. For example, if you earn 7% per year on an MMF, but inflation gets to 8%, you would be losing your purchasing power.

What You Should Look For When Choosing A Money Market Fund In Kenya

Past Performance of the Fund

It would be best if you looked into the past average returns of an MMF before deciding to invest in it. CMA requires the MMFs to post their daily returns in the local newspapers, which can be a great place to start your analysis. Assessing the diversification of a Fund’s investments is also vital to understand the portfolio better.

Minimum Investment and Top-up Amount

Before investing, you should know the minimum amount required to open an account and subsequent minimum top-up amounts. Most MMFs have a minimum investment amount as low as Kshs 500, which is considered relatively affordable.

Consistency

In addition to the past performance of the fund, it is essential to consider how consistent the performance of the fund has been to see if it will be a reliable investment.

Expenses

All investment funds typically charge expenses from the fund’s assets. It would be best to compare the management fees of different money market funds to find the one with the lowest costs. It is also worth noting that any interest earned from money deposited in an MMF is subject to a 15% withholding tax.

Considering these factors, let’s compare some of the money market funds in Kenya.

Key Takeaways

Money market funds are a low-risk, liquid investment option that can be a good choice for investors looking to grow their savings over time or who need a place to park their cash for a short time.

However, it is important to note that money market funds are not government-insured and that returns can vary depending on the fund manager’s performance. Therefore, it is important to research and choose a money market fund with a good track record and low fees.

Here are some key takeaways from this blog post:

- Money market funds are mutual funds that invest in short-term, low-risk securities, such as Treasury bills and commercial paper.

- Money market funds offer investors several benefits, including:

- Easy access to their money

- Higher interest rates than traditional savings accounts

- Low risk

- Transparency

- However, investors should also be aware of the following risks associated with investing in money market funds:

- Investments are not government-insured.

- Returns are not constant.

- Returns may not beat inflation.

- When choosing a money market fund, investors should consider the following factors:

- Past performance of the fund.

- Minimum investment and top-up amount.

- Consistency.

- Expenses.

Overall, money market funds can be a good investment option for investors looking for a safe and liquid way to grow their savings.

Disclaimer: The price of shares and the income therefrom if the collective investment scheme pays dividends may fluctuate; you are reminded that in certain specified circumstances, the right to redeem shares may be suspended.

The information provided on this platform, as well as the products and services offered, are intended solely for persons in regions and jurisdictions where such distribution and utilization are in accordance with local laws and regulations.

Ndovu does not promote its services in regions where it lacks the necessary licenses; It is exclusively available to persons residing in countries where it holds a valid license or has licensed partners. Ndovu does not extend its services to citizens of the United States, Canada, Japan, and other restricted territories.