For many people, the world of investing can be confusing. Many different investment funds are available, each with unique features, which sometimes proves an overwhelming task for beginners.

It is crucial to understand the different investment funds available and how to choose from them if one wishes to get started. Let’s look at the types of investment funds and how investors should select the best funds for their financial goals.

What are Investment Funds?

Investment funds, also known as collective investment schemes, contain capital deposits made by individual investors that are pooled together to be managed jointly on their behalf. These amounts are then invested in various securities, such as shares, bonds, real estate, etc.

What are the Different Types of Investment Funds?

Mutual Funds

A mutual fund is an investment fund that pools money from many investors to purchase securities. Mutual funds fall into four main categories – money market funds, bond funds, stock funds, and balanced funds. Each type has different features, risks, and rewards. Let’s look at these categories individually.

Money market funds.

Money market funds invest in short-term investments that have relatively low risks. These are generally the safest, most stable securities available, including Treasury bills, certificates of deposit, and commercial paper. They do not offer very high returns, but you’re less likely to lose your investment.

Bond funds.

Bond funds mainly invest in debt instruments, including government and corporate bonds. They typically have higher risks than money market funds because they aim to produce higher returns. Because there are many different types of bonds, the risks and rewards of bond funds can vary dramatically.

Equity funds.

Equity funds invest only in stocks and are the most common type of mutual funds.

Balanced funds.

As the name suggests, balanced funds invest in different asset classes, including stocks, bonds, money market instruments, or any alternative instrument. Their main objective is to reduce risk by spreading investments across asset classes, sometimes evenly distributed or balanced.

Index funds

Index funds are a popular type of mutual fund that follows a benchmark index, such as the S&P 500 or the Nasdaq 100. Their investment strategy is to purchase stocks in a primary market index, giving you a more diverse portfolio than buying individual stocks.

Exchange-traded Funds (ETFs)

An ETF is a basket of securities that trade on an exchange and track a particular index. Once you select an ETF, you’re invested in multiple companies at once, which is a terrific entry point into investing if you don’t know where to start.

Hedge Funds

This type of fund is designed for professional investors with a high-risk appetite. They usually require a high minimum investment or net worth and often target wealthy clients.

How do you choose the suitable funds for your financial goals?

To choose the right fund to invest in, one must consider several factors, including:

1. Your Risk Tolerance

With any investment, there are certain degrees of risk involved. Therefore, understanding how much trouble you are willing to take will also guide you toward the best investment strategy for your personal goals. If you are an investor who wants to take a high risk in exchange for a high return, then you should go for equity funds. If you are a conservative investor, bond funds offer better stability.

2. Your Return Objectives

Knowing your investment goals is another factor you should consider when choosing a fund. Consider investing in equity or aggressive balanced funds if you want high returns. But these funds also come with high risks, so if you’re going to invest your money somewhere not easily influenced by market volatility, you should consider bond funds. However, bond funds would offer lower returns.

3. Fund’s Historical Performance

It is crucial to consider the historical performance of the investment fund before investing. How does it compare against a benchmark? How does it compare against other funds in the same category? Are its returns consistent?

4. Fund manager’s track record and experience

The fund manager’s performance and the duration they have been overseeing the fund are also essential factors to consider when choosing an investment fund. For this, an investor should consider the fund manager’s track record with the fund in issue and other funds they have previously managed.

5. Fees associated with the fund

It’s essential to be conscious of fees charged by the fund because they can significantly impact your investment returns. For instance, the most common fee charged by all mutual funds and ETFs is called the expense ratio. It measures what it costs to manage the fund expressed as a percentage.

Besides these management fees, a 15% withholding tax is charged on any interest earned from your investment in a mutual fund in Kenya. Therefore, you should research the fund thoroughly to determine if you are getting sufficient value through the fund’s performance in return for paying the associated fees.

Diversifying Your Portfolio With Investment Funds

Diversification is spreading your money in different investments to reduce your exposure to risk without costing you your returns. At ndovu, we offer an easy and affordable way to diversify your portfolio through a curated selection of Exchange-traded funds (ETFs) on the platform.

These ETFs are carefully chosen based on liquidity, management fees, and prospects. They offer investors instant access to a diversified portfolio for a much lower cost than purchasing the individual investments yourself.

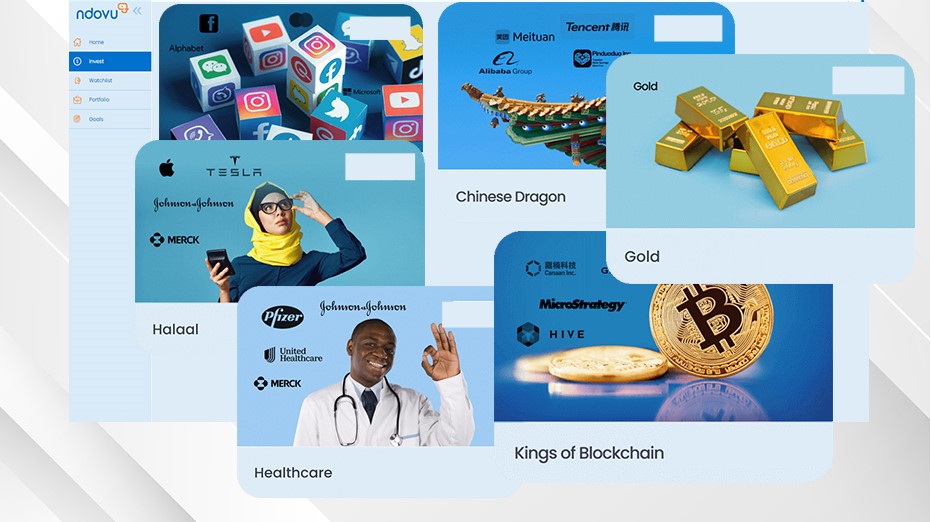

Whether you are an aggressive or conservative investor, the different funds offered on the platform can cater to your needs and include the following:

- Equity ETFs. Through various funds, you can invest in a basket of shares of different global companies, including blue chip, Wall Street, halal, and tech companies.

- Bond ETFs. The ‘safety net’ fund allows investors to invest in the U.S. bond market.

- Commodity ETFs. The ‘Gold’ fund offers investors the opportunity to invest in gold.

- Index ETFs. You can invest in funds that seek to replicate and track a benchmark index like the S&P 500 as closely as possible.

With as little as $50, you can begin your investment journey and diversify your portfolio.

Disclaimer: All ETF products are subject to risk, including country/regional, liquidity, and currency risks. Market prices of securities within the ETF may rise and fall, sometimes rapidly and unpredictably. It’s important to note that the right to redeem may be suspended and that past performance does not indicate future results.

The information provided on this platform, as well as the products and services offered, are intended solely for persons in regions and jurisdictions where such distribution and utilization are in accordance with local laws and regulations.

ndovu does not promote its services in regions where it lacks the necessary licenses; It is exclusively available to persons residing in countries where it holds a valid license or has licensed partners. ndovu does not extend its services to citizens of the United States, Canada, Japan, and other restricted territories.