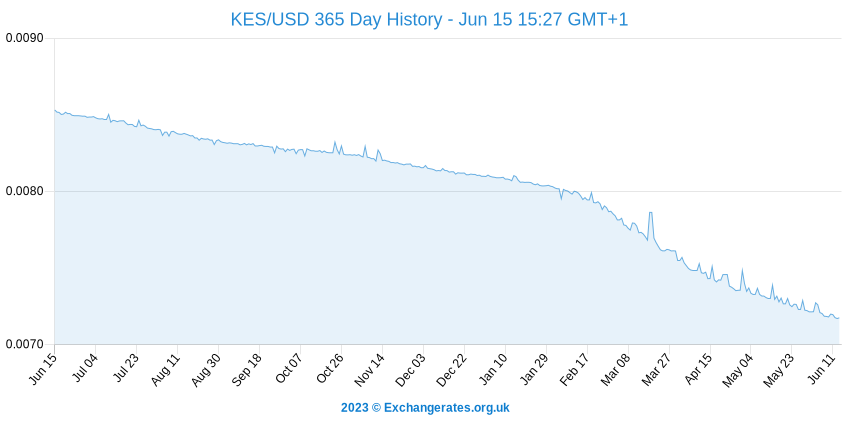

For almost three years, the value of the Kenyan shilling against the dollar has been steadily plummeting, with very few signs that it will recover. Before the Coronavirus pandemic started in February 2020, the shilling traded at around 100 against the U.S. dollar. The dollar, however, has become increasingly stronger since, seemingly due to the interest rate hikes by the Federal Reserve in the U.S.

How do these interest rate hikes strengthen the dollar? Interest rate hikes make the dollar, one of the world’s safest financial assets, more attractive to foreign exchange traders while dampening the appeal of holding riskier currencies like the Kenyan Shilling.

Over the past year alone, the shilling has lost almost 15% of its value. This means that Kenyans have to fork out 15% more shillings than they would have a year ago to buy the same amount of goods and services priced in dollars, such as imported oil, machinery, and electronics.

What does this mean for Kenyans? Let’s explore the financial impact of the depreciating Kenyan Shilling.

How Does The Depreciating Shilling Affect You?

While the depreciating shilling makes Kenyan exports more competitive in the global market and may attract foreign investors who see Kenya as a cheap destination to invest in, it has predominantly adverse effects on Kenyans, including:

The Increased Cost of Studying Abroad

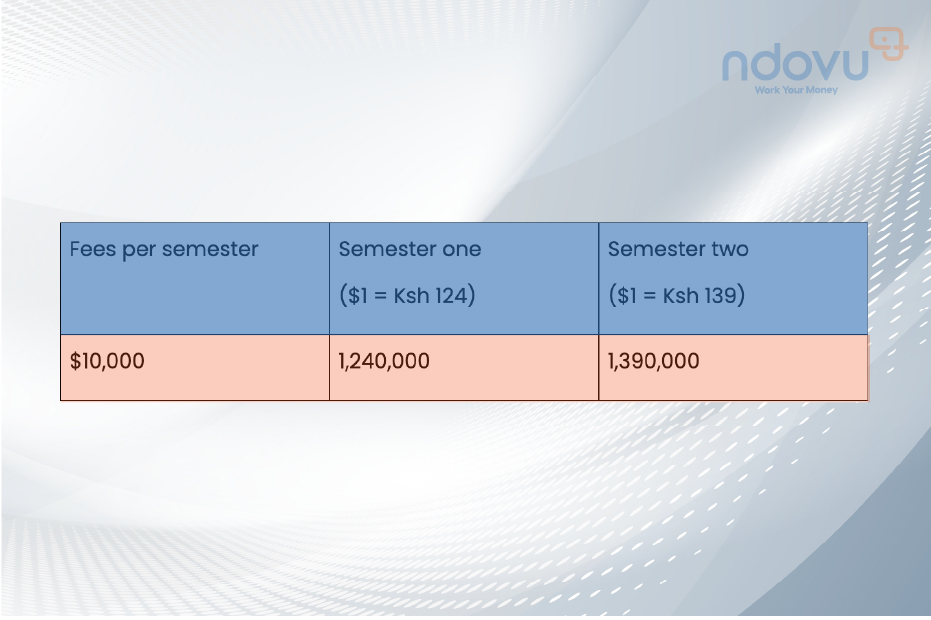

Due to the weakening shilling, those enrolled in foreign universities or paying for relatives studying abroad have had to reassess their educational budget. The fluctuating exchange rates have forced people to pay more for tuition and housing at a time when households are already struggling with the increasing cost of living in the country. This is incredibly hard-hitting for those paying for their education in installments, as while the fees from semester to semester may remain the same, the total cost increases due to the weakening shilling, as seen below.

In the example above, a student paying $10,000 per semester would have paid around Ksh 150,000 more for their second semester, assuming it started right now than they would have for their first semester at the beginning of the year.

An Increased Cost of Living

The weakening shilling also directly contributes to the increasing cost of living in the country. For instance, one of the components of an electricity bill in Kenya is a forex charge, which is a cost to cover the impacts of currency depreciation. A year ago, this charge was around 4.6%, but this has more than doubled to 9.5% of the total amount spent today, making electricity more expensive.

A depreciated currency also increases the prices of imported goods and services, leading to inflation and eroding Kenyans’ purchasing power.

Increased Debt Burdens

Kenyans with dollar-denominated loans or mortgages must pay more shillings to offset their debts. This applies to the government, and the steadily depreciating currency increases the cost of servicing foreign debt.

How Do You Protect Yourself Against the Depreciating Shilling?

The Kenyan shilling depreciation can provide an opportunity to benefit and improve one’s financial situation. We recommend holding 50% of your finances in USD-denominated assets to protect your wealth from currency depreciation.

These are simply assets priced in dollars, allowing you to invest and earn returns in dollars as the dollar is more stable and predictable than the Kenyan shilling. Moreover, holding USD assets provides a way to diversify your portfolio and reduce the risks associated with the weakening Kenyan shilling.

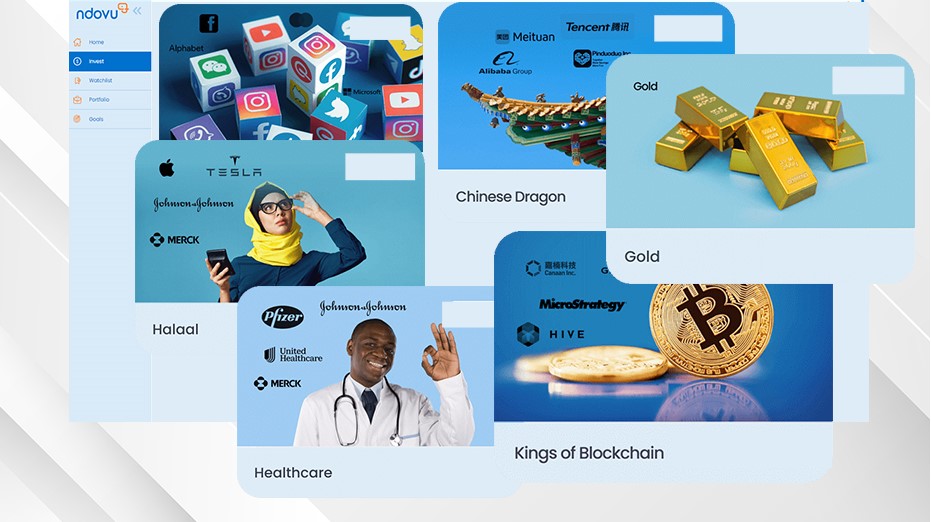

At ndovu, we provide easy and affordable access to US Dollar-based investments through our ETFs (exchange-traded funds). These are simply investment funds that allow you to buy a large set of individual stocks or bonds in one purchase enabling you to be invested in multiple companies simultaneously.

We offer a wide variety of dollar-denominated ETFs that cut across multiple industries, for example, the Techie ETF, which invests in companies in the technology industry like Visa, Apple, and Microsoft, among others, or the Halal fund that invests in companies that comply with Islamic finance principles. With as low as $50, you can begin your investment journey and build your wealth in USD.