Ndovu FAQs

Didn’t find your answer here? Send us a message, and we’ll help you out.

General

- What is Ndovu investment?Ndovu makes it easy and gives you access to invest in local and global financial markets. Buy a slice of your favourite international companies, right from the comfort of your home. We recognise investing can be daunting so if you don’t know how to get started, we guide you!

- How can I invest with Ndovu?Ndovu helps you manage your money through guided investing and by providing financial education. We are fiduciary, which means we act in your best interest. We’ll ask a bit about you when you sign up. Then, we’ll help you set financial goals and set you up with investment portfolios for each goal. For your short to long-term financial needs (ranging from emergencies, retirement, holidays, kids’ education, or down payment), our investment strategy is built on low-cost ETFs (exchange-traded funds) and a risk profile based on how long you plan to invest.

- What is Ndovu?Ndovu is an online investment platform that provides easy and affordable access to financial markets. Buy a slice of your favourite international companies, right from the comfort of your home. We recognise that investing can be daunting, so if you don’t know how to get started, we guide you!

- Who are the experts behind the scenes?Our team of investing experts make decisions about our portfolio strategies and fund selection with the help of industry experts. Our team has a breadth of financial and management experience, having worked at companies such as BlackRock, Deloitte, HSBC, Nairobi Securities Exchange, Old Mutual, APA Life Insurance and many more.

- How does Ndovu work?

Ndovu helps you manage your money through guided investing (we are a roboadvisor)and by providing financial education. We are fiduciary, which means we act in your best interest.

We’ll ask a bit about you when you sign up. Then, we’ll help you create financial goals and set you up with personalised investment portfolios.

For your short to long-term financial needs (ranging from emergencies, retirement, holidays, kids’ education or down payment on an asset), our investment strategy is built on low-cost ETFs (Exchange-Traded Funds) and a risk profile based on how long you plan to invest.

- What is best execution?

Best execution is a legal mandate that requires investment services firms to provide the most advantageous order execution for their customers given the prevailing market environment.

- Is there a charge for withdrawing cash from my Ndovu Account?

No. Ndovu doesn’t charge a withdrawal fee at the moment. We, however, reserve the right to levy appropriate charges should the need arise.

- How do I sell my investment?

Simply log in to your portfolio. Then choose from goal-based investing or general investing.

Then select the fund you wish to sell and click ‘withdraw’.

You will receive an email confirmation once your withdrawal order is finalized.

Please note once you click withdraw, the full investment amount held in that particular fund will be sold. You can’t sell part of your investment.

- How does Ndovu choose the ETFs on its platform?

There are over 8,500 exchange-traded funds (ETFs) in the world. The Ndovu investment committee has curated a select number of ETFs based on liquidity, diversification, management fees and future prospects.

- How do I buy funds?

You can buy funds online through the Ndovu website or the Android/iOS apps.

Please ensure to read the funds’ Key Features which are available from the individual fund factsheets on the website.

Once you are registered for online access, simply log in and select a new investment. Then choose your investing approach, goal-based investing or general investing. Follow the instructions and click the ‘Invest Now’ button.

Search for your chosen fund and continue to the confirmation page.

All trades will be placed on a best execution basis.

- What are the monthly minimum contributions?

There are NO monthly or quarterly contribution requirements. We, however, encourage you to invest regularly to build up significant value in your portfolio.

- What is the minimum amount I can start with?

The minimum amount of money needed to gain access to a portfolio on the Ndovu platform is Kshs 5,050, that’s it.

- Why invest in ETFs?

Exchange-Traded Funds (ETFs) are popular with investors because they offer access to a ready-made investment portfolio run by experts. You can invest from as little as $50 and get instant access to a diversified portfolio for a much lower cost than purchasing the individual investments yourself.

- What is an Exchange-Traded Fund (ETF)?

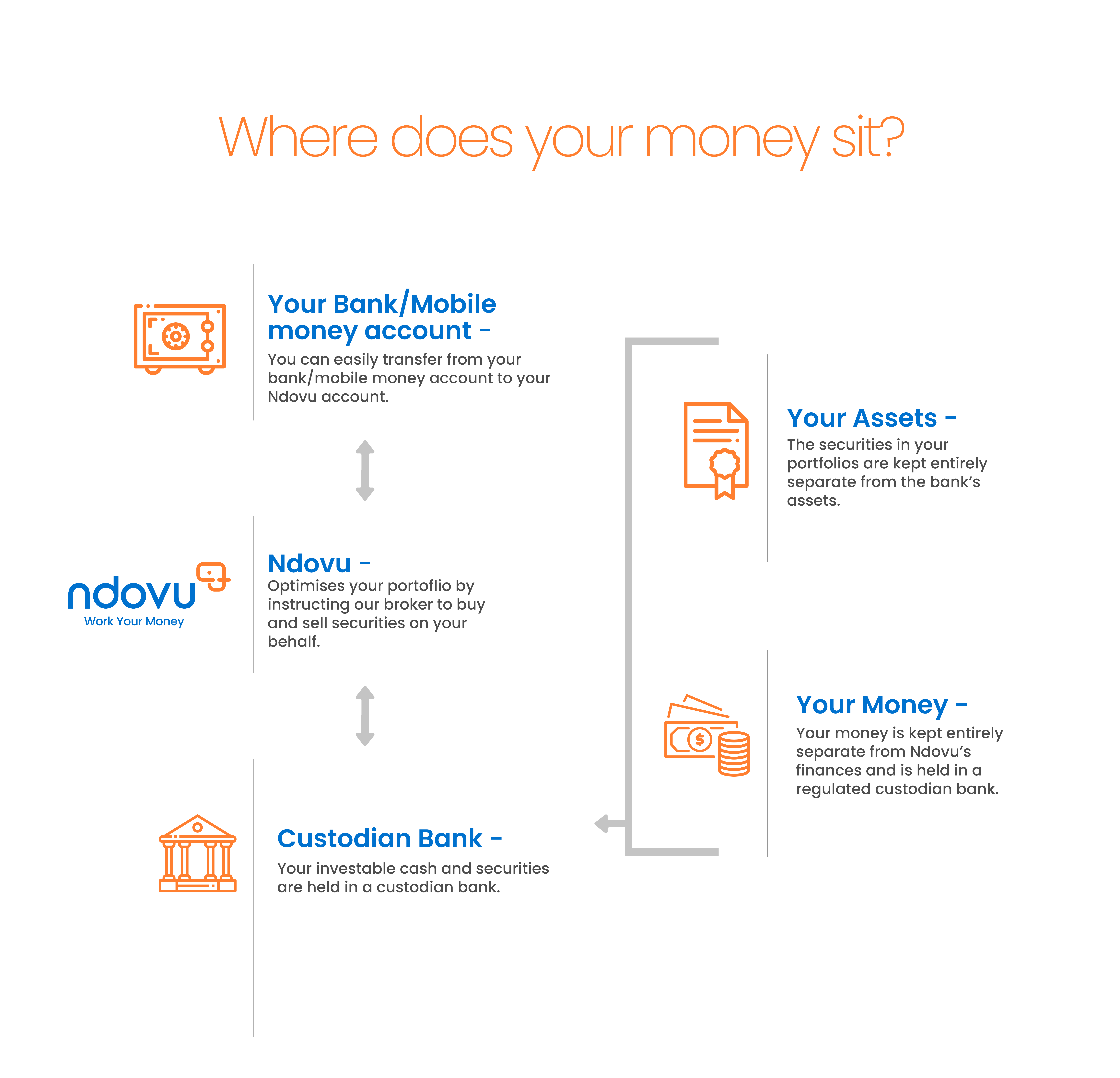

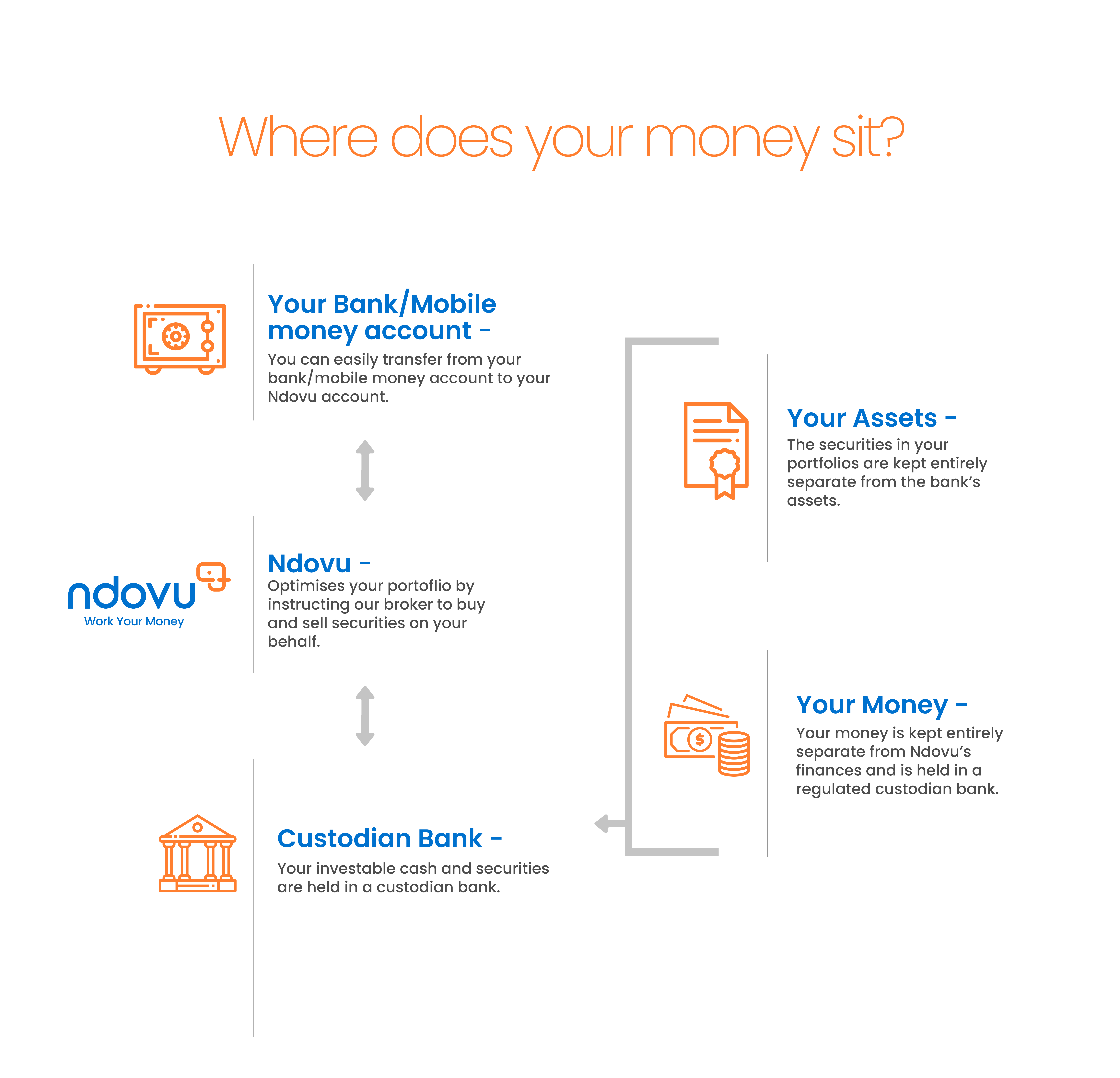

- Where does your money sit?

- Your Bank/Mobile money account – You can easily transfer from your bank/mobile money account to your Ndovu account.

-

Your money is held in a segregated account (a financial account where your money is kept safely in a trusted bank, separate from our company’s finances).

Ndovu optimises your portfolio by instructing our broker to buy and sell securities on your behalf.

- Your Assets – The securities in your portfolios are kept entirely separate from the bank’s assets.

- Your Money – Your money is kept entirely separate from Ndovu’s finances and is held in a regulated bank.

- Who holds the money and executes the trades?

Ndovu works with regulated banks in Kenya (licensed by the Central Bank of Kenya) and the United States (licensed by the Office of the Comptroller of the Currency – OCC ). We execute our trades via a major broker-dealer licensed by the US Securities and Exchange Commission.

- Is my money safe?

Your peace of mind is our highest priority. We’re committed to protecting your account with the highest standards of security available.

-

Regulation – Ndovu adheres to high standards of compliance and business conduct in each country of operation.

-

Writing on blockchain – Ndovu’s core is built on blockchain allowing us to accurately record all your transactions.

-

Military-level Security – We use secure servers and privacy verified by physical security. We adhere to industry standards and have strict internal policies to ensure the highest level of safety.

-

Everything is encrypted – We use state-of-the-art data encryption when handling your financial information and two-factor authentication (2FA) protection.

-

- The value of one of my investment funds is not changing. Why is this?

While ETFs are traded on daily basis, some funds (e.g., the money market funds) are not traded. Thus, the valuation may appear to be stagnant. Please reach out to ‘support@ndovu.co’ to request an emailed statement of such a fund.

- I placed an order but I cannot see it on my portfolio. What’s going on?

Access to the Ndovu platform requires the use of a steady internet connection. At times, clients may be located in places with poor connectivity. This may create challenges in order placement.

Should you experience this problem, immediately email ‘support@ndovu.co’.

- How long do fund orders take to process?

Once your order has been submitted, the order will be dealt with by the fund manager at the next available valuation point. Most funds will value daily at 1800 Eastern Standard Time, but please note this can vary from fund to fund.

Please see the fund factsheet for more information. Once dealt, your order status will update to ‘Dealt, awaiting confirmation. At this point, the order has been dealt with and the price fixed, although the fund manager may take up to five days to confirm the details of your completed deal. Your account will only be updated once confirmation has been received. When we receive confirmation of your deal your account summary and transaction history will be updated and you can access the details from your online account.

- I want to buy into dips in the fund price, how can I do this?

Timing fund deals to intra-day movements in the markets are notoriously difficult due to their forward pricing nature. One way to smooth entry points and benefit from dollar-cost averaging is to set up a regular investing instruction, whereby you automatically invest a set amount of a particular fund (or funds) each month.

Please remember that your long-term investment objectives should always take priority over any short-term fluctuations in price.

- What does each stage of the process mean?

Pending

Your trade has been received by Ndovu. Your purchase will remain pending until your sale has been confirmed by the fund manager.

Dealt, awaiting confirmation

Your order has been dealt with. The fund manager can take up to five days to confirm the details of your completed deal, although in most cases it takes less than 24 hours.

Completed

When we receive confirmation of your deal your account summary and transaction history will be updated and we will send an email confirmation.

- When are deals/orders executed?

All trade instructions & payments received by 12 noon (EAT) are placed on the same day.*

All trade instructions & payments received after 12 noon (EAT) will be placed on the following day.*

*Where the following day is not a weekend or public holiday in the US or Kenya. Please note that all trade instructions are placed on a best execution basis.

- Can I cancel an accidental order?

Yes. An accidental investment/withdrawal order can be reversed within 5 minutes. Please email ‘support@ndovu.co’ should you require trade cancellations.

- I have withdrawn from a goal portfolio. How will my proceeds be paid?

As the goal portfolio is made up of different currencies, the proceeds from the sale of the USD fund will be paid separately from the proceeds from the sale of local currency funds.

- Where will my withdrawal proceeds be paid?

In compliance with the laid down international standards on the Prevention of Money Laundering, the amount that you withdraw will be paid back to its original source i.e., if you invested via mobile money, the proceeds will be paid back to the same mobile money account.

In addition, the withdrawal will be paid back in the original investment currency i.e., if you invested in Kenyan Shillings, the refund will be in Kenyan Shillings.

- Can I request for the erasure of my data?

Yes. Please email ‘support@ndovu.co’ with your request. Upon verification, your request will be handled subject to the provisions of the Data Protection Act, the Capital Markets Act and the Proceeds of Crime and Anti-Money Laundering Act.

- What happens if I want to close my account or withdraw funds?

Ndovu clients enjoy full liquidity. This means that clients can withdraw their funds whenever* they would like. There is no lock-up period.

*Processing time is 3 business days in line with industry standards.

- How do I know what price I will get when I place a trade?

The vast majority of funds price each working day at 1800 Eastern Standard Time. When you place an order, it will be traded at the next available valuation point. This means that you will know the exact price after you place the deal.

- How do I buy funds?You can buy funds online through the Ndovu website. Please ensure you have read the fund’s Key Features first which are available from the individual fund factsheets on the website. Once you’re registered for online access, simply log in and select a new investment. Then choose your investing approach, goal-based investing or general investing. Follow the instructions and click the ‘Invest Now’ button. Search for your chosen fund investment and continue to the confirmation page. All trades will be placed on a best execution basis.

- Is there a charge for withdrawing cash from my Ndovu Account?Yes. Ndovu charges a withdrawal fee of $25 on USD investments and 50bob on KES investments.

- How do I sell my investment?Simply log in and select my portfolio. Then choose from goal-based investing or general investing. Then select the fund you wish to sell and click withdraw. Please note once you click withdraw, the full investment amount held in that particular fund will be sold. You can’t sell part of your investment. All trade instructions & payments received by 12noon (EAT) are placed on the same day.* All trade instructions & payments received after 12noon (EAT) will be placed on the following day.* *Where the following day is not a weekend or public holiday in the US or Kenya. Please note that all trade instructions are placed on a best execution basis.

- Why invest in ETFs?Exchange-Traded Funds (ETFs) are popular with investors because they offer access to a ready-made investment portfolio run by experts. You can normally invest from $1000 as a lump sum or $10 per trade and get instant access to a diversified portfolio for a much lower cost than purchasing the individual investments yourself.

- How does Ndovu work?Ndovu helps you manage your money through guided investing and by providing financial education. We are fiduciary, which means we act in your best interest. We’ll ask a bit about you when you sign up. Then, we’ll help you set financial goals and set you up with investment portfolios for each goal. For your short to long-term financial needs (ranging from emergencies, retirement, holidays, kids’ education, or down payment), our investment strategy is built on low-cost ETFs (exchange-traded funds) and a risk profile based on how long you plan to invest.

- What is Ndovu?Ndovu makes it easy and gives you access to invest in local and global financial markets. Buy a slice of your favourite international companies, right from the comfort of your home. We recognise investing can be daunting so if you don’t know how to get started, we guide you!

- How long do fund orders take to process?Once your order has been submitted for dealing the order will be dealt with by the fund manager at the next available valuation point. Most funds will value daily at noon, but please note this can vary from fund to fund. Please see the fund factsheet for more information. Once dealt your order status will update to ‘Dealt, awaiting confirmation. At this point, the order has been dealt with and the price fixed, although the fund manager may take up to five days to confirm the details of your completed deal. Your account will only be updated once confirmation has been received. When we receive confirmation of your deal your account summary and transaction history will be updated and we will generate a contract note.

- Does Ndovu support accounts for minors?We do not offer accounts for minors at the moment. All customers must be at least 18 years of age to consent to all our agreements.

- Who is eligible to use Ndovu?Ndovu currently operates in Kenya and for regulatory reasons cannot accept U.S. citizens. We, however, welcome other nationalities, subject to the provision of acceptable Know Your Customer (KYC) documentation. Here is a breakdown of the nationalities we accept.

- What is an exchange-traded fund (ETF)An exchange-traded fund (ETF) is a collection of shares that make it easier to invest in a large number of companies with little risk and maximum reward. An exchange-traded fund (ETF) is a security that tracks an index, a commodity, or a basket of assets—just like an index fund—but trades like a stock on an exchange. We chose each ETF we invest your money in because of liquidity, diversification, and low management fees.

- What investments are available on Ndovu?Here at Ndovu, we help make the most of your money, and our experts have put together tailor-made portfolios so that you don’t have to. If you are an amateur investor, and you need some help, we select the investments on your behalf through these tailor-made portfolios. If you are an expert investor, you will be able to buy stocks in specific companies or industries through Exchange Traded Funds (ETFs). Securities available on Ndovu in Kenya and globally are as follows:

- Government Bonds

- Unit Trusts

- Equity ETFs

- Bond ETFs

- Commodity ETFs

- What happens if I want to close my account or withdraw funds?Ndovu clients enjoy complete liquidity. This means clients can remove their funds whenever they would like. There is no lock-up period. *processing time is about 3 days in line with industry standards.

- What are the monthly minimum contributions?There are NO monthly or quarterly contribution requirements. We, however, encourage you to invest regularly to build up significant value in your portfolio.

- What is the minimum amount I can start with?The minimum amount of money needed to gain access to a portfolio on the Ndovu platform is Ksh 5,000 ($50), that’s it.

- Where does your money sit?

- Your Bank/Mobile money account – You can easily transfer from your bank/mobile money account to your Ndovu account.

- Custodian Bank – Your investable cash and securities are held in a custodian bank. Ndovu optimises your portfolio by instructing our broker to buy and sell securities on your behalf. We follow a custodian structure, keeping your assets in a separate account.

- Your Assets – The securities in your portfolios are kept entirely separate from the bank’s assets.

- Your Money – Your money is kept entirely separate from Ndovu’s finances and is held in a regulated custodian bank.

- Is my money safe?Your money is held in custodial accounts (a financial account where your money is kept safely in a trusted bank, separate from our company’s finances). Should anything happen to us, your money is safely kept in the custodial account and the bank remits the money to you.

- Who holds the money and executes the trades?Ndovu partners with regulated custodians in Kenya (licensed by both the Central Bank of Kenya and the Capital Markets Authority) and the United States (licensed by the Office of the Comptroller of the Currency (OCC)). We execute our trades via a major broker-dealer licensed by the US Securities and Exchange Commission.

- Who are the experts behind the scenes?Our team of investing experts make decisions about our portfolio strategies and fund selection with the help of industry experts. Our team has a breadth of financial and management experience, having worked at companies such as BlackRock, Deloitte, HSBC, Nairobi Securities Exchange, Old Mutual, APA Life Insurance, and many more.

- I want to buy into dips in the fund price, how can I do this?Timing fund deals to intraday movements in the markets are notoriously difficult due to their forward pricing nature. One way to smooth entry points and benefit from dollar-cost averaging is to set up a regular investing instruction, whereby we automatically buy a set amount of a particular fund (or funds) each month. Please remember that your long-term investment objectives should always take priority over any short-term fluctuations in price.

- How do I know what price I will get when I place a trade?The vast majority of funds price each working day at noon. When you place a deal it will be traded at the next available valuation point, typically noon the next working day. This means that you will not know the exact price that you will buy or sell at when you place the deal. You can however view the latest fund price on the portal. The price will always have a ‘prices as at’ date stamp to show when the price is from. Fund prices are updated overnight and will display the last available price.

- What does each stage of the process mean?Pending Your trade has been received by Ndovu. Your purchase will remain pending until your sale has been confirmed by the fund manager. Dealt, awaiting confirmation Your order has been dealt with. The fund manager can take up to five days to confirm the details of your completed deal, although in most cases it takes less than 24 hours. Completed When we receive confirmation of your deal your account summary and transaction history will be updated and we will send an email confirmation.

- How are trades placed?All trade instructions & payments received by 12noon (EAT) are placed on the same day.* All trade instructions & payments received after 12noon (EAT) will be placed on the following day.* *Where the following day is not a weekend or public holiday in the US or Kenya. Please note that all trade instructions are placed on a best execution basis.

- What investments are available on Ndovu?

Here at Ndovu, we help make the most of your money, and our experts have put together tailor-made portfolios so that you don’t have to.

If you are an amateur investor and you need some help, we select the investments on your behalf through these tailor-made portfolios.

If you are an expert investor, you will be able to buy stocks in specific companies or industries through Exchange Traded Funds (ETFs).

Securities available on Ndovu are as follows:

-

Government Bonds

-

Unit Trusts

-

Equity ETFs

-

Bond ETFs

-

Commodity ETFs

-

- Who is eligible to use Ndovu?

Ndovu currently operates in Kenya and for regulatory reasons, cannot accept U.S. citizens. We, however, welcome other nationalities, subject to the provision of acceptable Know Your Customer (KYC) documentation. Here is a breakdown of the nationalities we accept – List of Eligible Countries

- I don’t have an ID/Passport. Can I still invest?

Unfortunately, no. As per the law, we have to verify the identity of each client before investing their funds.

Any client who deposits funds but doesn’t provide their identification documents will have their cash refunded.

- Does Ndovu support accounts for minors?

At the moment, we do not offer accounts for minors. All customers must be at least 18 years of age to consent to all our agreements.

- I upgraded to the Premium Plan. When will I have my financial planning session?

The financial planning sessions are immensely popular and are available on a first-come-first-serve basis. At times, this may entail you joining a wait list until a calendar slot opens up. We are a quality-centred service and thus request for your patience as we go through the booking schedule.

- I upgraded to the Premium Plan but my investment is lower than $1K. Does this have any effect?

Yes. As the Premium Plan is designed for investment minimums of USD 1K, any client with a balance below this will be entitled to only one financial planning session, upon onboarding. Future sessions will only be accessed by meeting the threshold.

Pricing

- When is Ndovu fee charged?

Ndovu fee is deducted prior to your money being invested into ETFs. Our fees are clearly stated here

- What are ndovu’s fees?

ndovu’s offers personalised financial advice, access to low-cost, globally diversified portfolios, dividend reinvestment, and financial education. We have two subscription plans:

The basic plan charges 4.5% per year on global funds and between 0% – 1% on savings and fixed returns (the lowest in the industry) with a KES 7,500 ($50) minimum investment amount.

The Standard plan charges 4% per year on global funds and between 0% – 1% on savings and fixed returns (the lowest in the industry) with a KES 7,500 ($50) minimum investment amount. This package grants you access to a personalized portfolio and an investment performance tracker.

The Ultimate plan charges 3.5% per year on global funds and between 0% – 1% on savings and fixed returns (the lowest in the industry) with a KES 7,500 ($50) minimum investment amount. This will give you access to a dedicated relationship manger and personalized portfolio.

This subscription fee covers the advice you receive, the transactions, trades, and all other account administration.

For further information, please click here.

Promotions

- Are there Promotions?

Open an account and get $5 of free stock

- How does it work?

We will add $5 into an exchange-traded fund (ETF) when you fund your account with $50. You are required to hold the $5 in your investment portfolio for a minimum of 12 months and can only withdraw it afterwards.

- Can I open a second Ndovu account to get $5 of stock?

No, each person can only own one Ndovu account.

- Which ETF will I get?

The ETF allocation is at the discretion of the investment committee.

- Promotion Terms & Conditions?

This offer is only valid for selected individuals who have not started / completed their Ndovu application, signed up on the waitlist, individuals who have an approved account with zero activity (no trades places, deposited funds etc), and individuals without a Ndovu account, who fulfil the conditions in our promotion. Individuals must sign up through our waitlist promotional page to be eligible.

Ndovu reserves the right to change the offer terms or terminate the offer at any time without notice. The offer is limited to one per account, with no more than one account enrolled per customer. The $5 bonus, when combined with the value received from all other offers in the current calendar year, may not exceed $100 per person unless expressly stated in writing from hi@ndovu.co.

The offer is not transferable, saleable, or valid in conjunction with certain other Ndovu offers. Employees, contractors, or persons similarly associated with Ndovu or a Ndovu affiliate; members of their household; and employees of any securities regulatory organization or exchange are not eligible.

Ndovu may decline requests to enrol in the offer at its discretion. Other restrictions may apply. The $5 bonus exchange-traded fund (ETF) is selected randomly, when the bonus criteria are met, by our investment management committee. We’ll add $5 into an ETF when you deposit $50 into your Ndovu account and fulfil the conditions in your promotion. You are required to hold the $5 or more in your investment portfolio for a minimum of 12 months (365 calendar days) and can withdraw it thereafter if you have funded your account with a minimum of an additional $50. For any inactive account for the first 4 months (120 calendar days) since joining the platform, the company has the right to recall the rewards unless stated otherwise in writing from hi@ndovu.co.

Each referral made under your account must invest a minimum of $100 in the first 12 months for you to get your $5 investment.

We offer access to investment tools and education to help you make investment decisions, but this information is for informational and educational purposes only.

Consult with your tax advisor about the appropriate tax treatment for this offer and any tax implications associated with receipt of a $5 fund bonus before enrolling. Ndovu does not take responsibility for any tax-related to this $5 fund bonus.

About Us

- What are Ndovu’s core values?

Our mission is to empower people to create wealth so they can live secure and rewarding lives. Ndovu is built on 4 pillars.

-

Do what is right for the customer – simply put, your goals are our goals. Every decision is centred around our customers’ needs & convenience

-

Keep it simple – we strive to keep our solution simple. Life is complicated enough as it is. Your finances shouldn’t be.

-

Trust through transparency. It is empowering to know how we manage your investments & what fees you’re being charged.

-

We are creative – we challenge the status quo to bring better, smarter solutions to you.

-

KYC

- What is KYC?

KYC stands for “Know Your Customer.” It is a process implemented by businesses and financial institutions to verify the identity of their customers. KYC involves collecting and assessing information about individuals or entities to ensure they meet regulatory requirements and to prevent activities such as fraud, money laundering, and other illicit financial transactions.

- Why is KYC important for ndovu?

KYC helps us comply with regulations and ensures the security and authentication of transactions on our platform.

- What documents are required for KYC on ndovu?

To complete KYC, investors need to provide their National Identification documentation/passport, PIN certificate, business registration documents and any other document upon request which may vary depending on your country, account type and nature of transaction.

- How do I submit my KYC documents?

All documents are uploaded through a seamless process on ‘ndovu’ portal. This is accessed through the menu under manage account (Personal information).

- How long does KYC verification take?

Our team will verify your KYC documents in a quick and efficient manner within 48 hours.

- Can I start trading without completing KYC?

Completing full KYC is mandatory for all users before they can commence trading on ‘ndovu’, as it is a regulatory requirement.

- Is my personal information secure during the KYC process?

Yes, ndovu is fully compliant with the Data Protection Act and the regulations therein and has a robust security system to safeguard our clients data from malware. All your data is protected and will not be shared or sold to any third party.

- What happens if my KYC submission is rejected?

If your KYC submission is rejected, you will receive detailed instructions on what to address in order to complete your KYC.

- Are non-Kenyan residents required to complete KYC?

Yes, KYC is a mandatory requirement for all users including non-Kenyan residents, to ensure compliance with regulatory standards across all countries of operation.

- Can I update my KYC information if it changes?

Yes, you can update your KYC information by accessing the menu under manage account (Personal information) on the ‘ndovu’ platform.

- What is ‘ndovu’ Pocket?

The ‘ndovu’ Pocket is a feature that allows you to easily perform transactions on the ‘ndovu’ platform, including disinvestment, investments, and withdrawal of investments, without incurring additional charges by going through your bank accounts or mobile money accounts.

- What can I do using the ‘ndovu’ Pocket?

- The ‘ndovu’ Pocket allows you to disinvest from active investments and reinvest in new funds on the ‘ndovu’ platform.

- The ‘ndovu’ Pocket allows you to seamlessly invest your money into the fund of your choice in multiple currencies.

- The ‘ndovu’ Pocket allows you to easily withdraw your money from the ‘ndovu’ platform to your bank account or mobile money Pocket of your choice.

- Why should I use the ‘ndovu’ Pocket?

The ‘ndovu’ Pocket makes the reinvestment process easier by eliminating the need to move your funds to a bank or mobile money account before reinvesting, making it faster and more convenient.

- Can I withdraw funds directly to my bank account without using the ‘ndovu’ Pocket?

No, all disinvestments are settled to your ‘ndovu’ Pocket. From the Pocket you can initiate a withdrawal to the account of your choice in your preferred currency.

- Are there any fees associated with the ‘ndovu’ Pocket?

ndovu does not levy any fees for the Pocket at this time all transaction costs incurred are standard charges from the bank or Mobile money Pocket.

- Is there a limit to the amount I can hold in the ‘ndovu’ Pocket?

There is no limit to the funds you can hold in your Pocket.

- How quickly can I withdraw funds from the ‘ndovu’ Pocket?

- Withdrawal times from the ‘ndovu’ Pocket are typically quick, providing users with efficient access to their funds.

- Mobile money transactions may take up to 48 hours while bank transactions may take up to 72 working hours.

- Can I earn interest on funds held in the ‘ndovu’ Pocket?

Funds held in the ‘ndovu’ Pocket are not subject to earnings at this time, however you can seamlessly invest into one of our high yielding funds.

- Is the ‘ndovu’ Pocket available for all types of investments?

Yes, the ‘ndovu’ Pocket allows you to invest in different funds in multiple currencies.

- How do I track my transactions in the ‘ndovu’ Pocket?

Users can easily track their ‘ndovu’ Pocket transactions through the platform’s user interface, providing transparency and visibility into all Pocket-related activities.