We live in a digital age where technology reigns supreme, shaping every aspect of our lives from dawn to dusk. It’s hard to find an industry that the power of technology hasn’t touched. With faster and cheaper computers within our reach, businesses and society have undergone remarkable transformations, undoubtedly for the better.

Consider this staggering fact: people across the globe now spend an estimated seven hours each day online. Moreover, experts predict that the ever-growing artificial intelligence (AI) sector will be worth a mind-boggling $400 billion by 2025. Investing in the technology industry holds incredible potential.

But how can you get in on the action? How can you dive into the world of technology investment? Well, fear not because we’ve got you covered.

Enter Exchange-Traded Funds (ETFs), the gateway to the profitable tech industry.

How To Own A Piece Of The Pie in the Technology Sector

A technology ETF is an exchange-traded fund that invests in a portfolio of companies in the technology sector and related sectors. Tech ETFs include companies that create and distribute hardware, such as computers, smartphones, semiconductors, and other electronics, and software, such as artificial intelligence, cybersecurity, and cloud technology.

Technology stocks typically have a high-risk and high-reward relationship, and while some go on to become the next Apple or Amazon, others fail miserably.

Therefore by holding a variety of tech firms as opposed to just one, technology ETFs reduce the risks associated with investing in individual stocks/shares. Reduced risk increases the likelihood that you will reap the rewards of a possible tech stock winner without worrying about your portfolio crashing when a tech stock loser withdraws from the fray.

Why Should You Invest In Technology Exchange-Traded Funds (ETFs)?

- Growth potential – The technology sector has been one of the fastest-growing globally, constantly evolving and developing new technologies and products.

- Diversification – More specific exposure to technology and related sectors offers potential diversification benefits to portfolios, and while it’s impossible to know if investing in tech will guarantee you massive gains long-term, diversifying the companies in your portfolio through an ETF can help you safeguard against risk.

- Cost-effectiveness – Because most technology ETFs take a passive investment approach, aiming to mimic an index rather than trying to pick winners, management costs are kept low and do not eat up a significant portion of your returns.

- Transparency – Technology ETFs also offer the other benefits of ETFs that you may already be familiar with. They are transparent – you can see exactly which stocks the ETF holds by checking the ETF issuer’s website.

- Exposure to global giants – Investing in technology ETFs grants you access to market-leading technology stocks such as Amazon, Apple, and Meta, some of the world’s largest companies.

What Are The Risks Of Investing In Technology ETFs?

Like with any other investment, ETFs carry potential risks. Here are some of the significant risks you should consider before investing:

- The funds’ price may fluctuate, indicating that technology stocks are more volatile.

- Inflation can reduce the valuation of tech stocks.

- Some technology ETFs require more time to research.

- There is a risk of over-concentration if you only invest in tech companies.

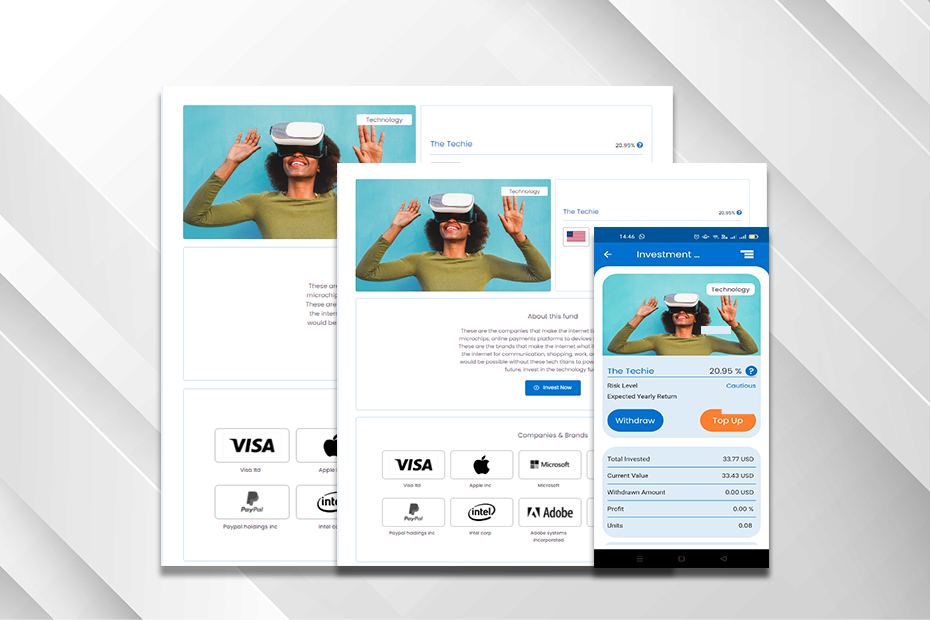

How to Invest In ndovu’s Technology Fund

Through ndovu, it is easier for first-time investors to access a broader range of investment options they may have previously needed to be aware of due to a lack of access to the relevant information. Our secure online investment platform offers an easy and affordable way to invest in the technology industry through our Techie fund, which provides exposure to established tech giants and emerging technology leaders.

Learn more about funds here.

It is, however, essential to note that the value of your investments can go up and down, and you may get back less than you invest. Additionally, the fund’s past performance does not guarantee future results. Therefore, you should consult a financial advisor and research if you’re unsure which investments suit you. Sign up on ndovu today and take advantage of this opportunity to protect and grow your wealth while diversifying your portfolio.