In today’s dynamic world, saving and investing have evolved beyond our actions to improve our financial standing into experiences that impact more than the zeros in our accounts. These two life skills also influence our self-confidence, habits, mindset, and peace of mind. Additionally, we must frequently adapt and appropriately react to changing market conditions to build lasting wealth.

That’s why, in its mission to make investing in local and global financial markets simple, secure, and affordable, ndovu has introduced a new feature to enhance your investment experience so you can focus on growing wealth. Welcome to the ultimate guide to maximizing your investments with the ndovu Pocket!

The ndovu Pocket – Disinvest, Reinvest & Withdraw with Seamless Efficiency.

As we welcome a fresh start, we’re excited to introduce our latest innovation – the ndovu Pocket. Your feedback inspired this revolutionary feature and is here to make your investment journey seamless and stress-free. With the ndovu Pocket, you can effortlessly disinvest, reinvest, and withdraw your funds – all with complete transparency.

Let’s explore how it works.

Manage your Investments with Ease. Reap rewards using the ndovu Pocket for investments.

The ndovu Pocket includes three simple functions designed to elevate your investment game. These three functions will be your game changer for long-term financial goal investments. Let’s dive into these functions.

Invest in Funds and Grow Your Wealth.

Secondly, the new ndovu Pocket introduces the “Invest” option, providing direct access to our range of investment funds. Explore our investment funds to enhance your portfolio. The new Pocket breaks free from limitations, empowering you to invest funds across the different products.

Enjoy a Simpler Withdrawal Process.

With the Pocket, you can easily withdraw money from your bank account or mobile device.

How to Activate and Enjoy Your Pocket: A step-by-step procedure on how to access the ndovu Pocket.

This step-by-step guide lets you activate your Pocket and explore its full potential!

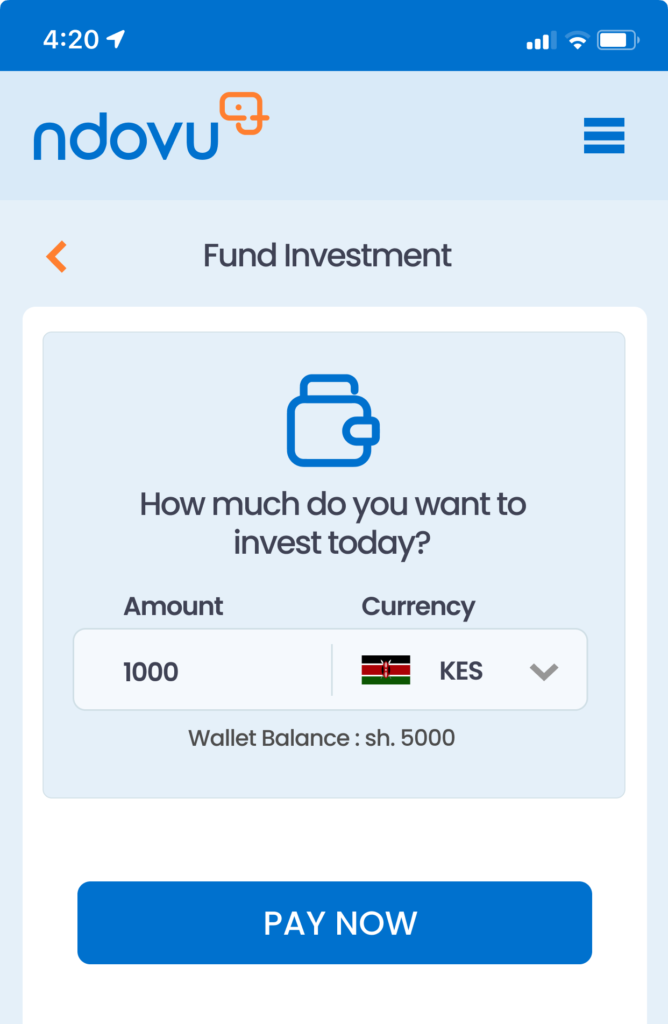

How to Invest.

- Log in to your ndovu account.

- Select the ndovu Pocket.

- Click on the invest option.

- Select a fund you wish to invest in.

- Acquaint yourself with the fund.

- Click on the invest button.

- Enter the amount to invest.

- Click pay to invest.

- Select your payment method.

- Provide your payment details.

- Ascertain your details and click Pay now.

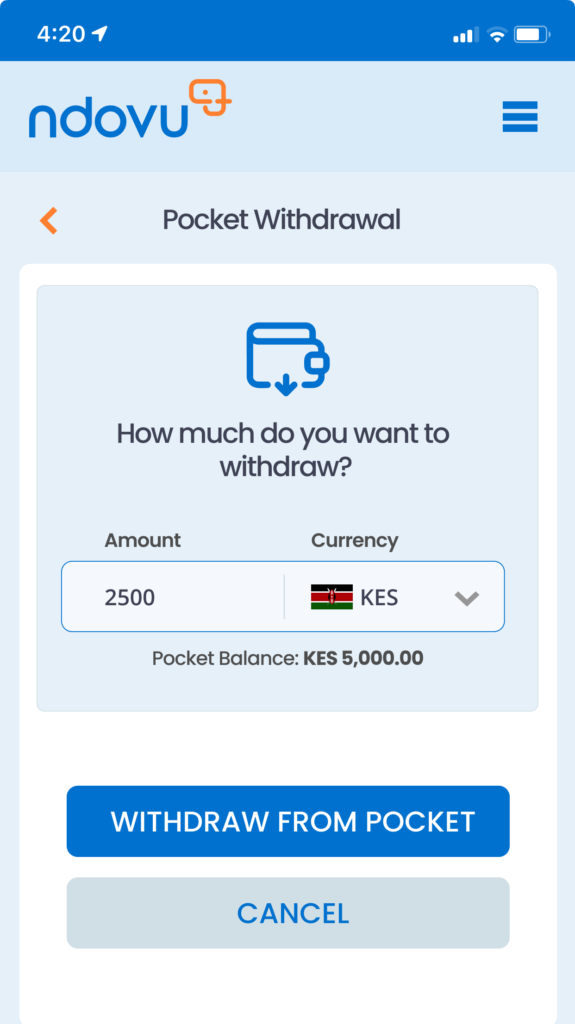

How to Make Withdrawals.

- Log in to your ndovu account.

- Select the ndovu Pocket.

- Click on the Withdraw option.

- Enter the amount you wish to withdraw.

- Select withdraw funds to your Mpesa or bank account.

- Provide your payment details.

- Confirm your transaction details.

- Click Withdraw from Pocket.

Take Control and Empower Your Financial Goals in 2024 with the ndovu Pocket.

At Ndovu, we are committed to providing you with all the tools you need to achieve your financial goals. With the new ndovu Pocket, you can manage your investments and seamlessly withdraw your bank account or mobile money. Experience a new era of investing propelled by efficiency, convenience, and simplicity with the Pocket today!

Do you have questions? Click here to visit our FAQs page. Email support@ndovu.co, call or WhatsApp 0715530530 to speak to our dedicated customer support team about this exciting new feature.

Disclaimer: Ndovu is a regulated Robo-advisory platform operated by Ndovu Wealth Limited (‘NWL’). NWL is a Fund Manager licensed by the Capital Markets Authority (Kenya).

The information provided on this platform and the products and services offered are intended solely for persons in regions and jurisdictions where such distribution and utilization are in accordance with local laws and regulations.