On February 24, 2022, Russia invaded Ukraine; an alarming development in the deeply rooted conflict between the two countries. Though originally perceived to be a quick, but universally condemned victory on Russia’s end, one year later there is still no end in sight.

As effects of this escalated move continue to be felt globally, different questions arise. How does war affect stock market performance? What are the factors that influence the market’s reaction during the outbreak of war? Do wars have a sustained impact on financial markets? We will explore these aspects using historical data and analysis.

How Do Wars Affect Stock Market Performance?

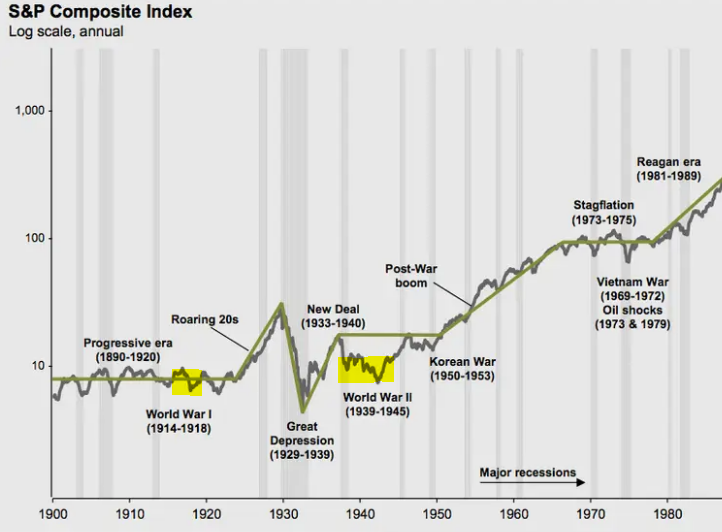

Historically, wars have tended to have a negative impact on stock markets. This is because wars introduce uncertainty and instability into the economy. In the graph below we can see the performance of the S&P 500 index during two of the most significant wars in modern history: World War I and World War II.

As we can see from the graph, the S&P 500 index performed poorly during the two wars. The outbreak of World War I in 1914 saw the index drop by 18% in just three months. World War II had an even more significant impact, with the index dropping by 30% in the year following the start of the war. The Gulf War, which began in 1990, also had a negative impact on the market, with the index dropping by 15% in the six months following the outbreak of the conflict. It is therefore quite evident that markets react poorly to the outbreak of war, however it can be argued that these reactions are influenced by different factors.

What Factors Influence The Market Reaction During The Outbreak Of A War?

Not all wars have the same impact on the stock market. Different factors, such as the nature of the conflict, can influence the market’s reaction to war. The Vietnam and Korean wars, for instance, had more muted impacts on the global market and trade, than World War II.

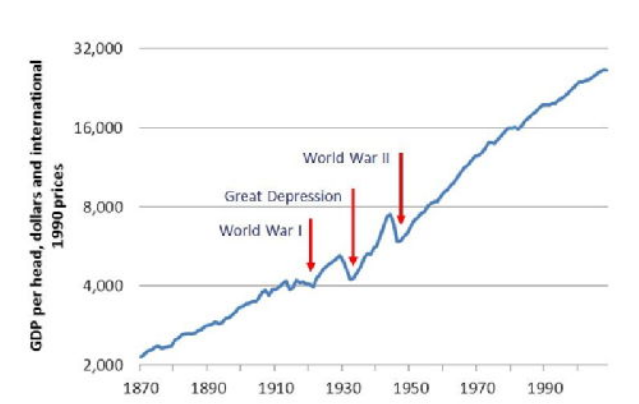

The strength of the economy prior to the outbreak of war can also influence the market’s reaction. The stronger the economy is prior to the outbreak of war, the more likely it is that the stock market will recover quickly. During World War II for example, the US economy was in a period of strong growth, with GDP growth rates averaging over 10% per year in the years leading up to the war. This helped to mitigate the impact of the conflict on the stock market, with the economy recovering relatively quickly following the end of the war as can be seen in the graph below.

Government spending during wartime can also influence stock market performance. Defense spending, in particular, can stimulate certain sectors of the economy, such as defense contractors and infrastructure, leading to positive market performance in some cases. Therefore, while it can be seen that wars have a negative impact on financial markets and different factors influence how markets react at the onset of war, a single question remains. Do wars have a lasting effect on financial markets?

Do Wars Have A Sustained Impact On Financial Markets?

During World War I, the New York Stock Exchange (NYSE) was closed for four months, and when it reopened in 1915, it experienced significant volatility with the Dow Jones Industrial Average trading at 60% of its January 1913 level. American stocks however rallied, more than doubling by the end of November 1916 as can be seen in the graph below.

In the lead-up to the Iraq War, which began in 2003, markets were highly volatile, with the Dow Jones Industrial Average falling by over 2,000 points in the first six weeks of the conflict.

However, following the start of the war, the Dow Jones index began to recover and experienced a rally that continued through the end of 2003, gaining more than 30% from its March 2003 low as can be seen in the graph below.

After Russia invaded Ukraine it rattled global markets. In the U.S, the S&P 500 index fell more than 7% in the days and weeks immediately following the incursion, as the U.S. and other nations stepped up severe economic sanctions on Russia and investors worried about the impact of commodity prices. But, a month later as can be seen in the graph below, markets had rebounded and the S&P was trading at a level higher than before the invasion.

What Does This Mean For Investors?

There is no denying that war has a negative impact on financial markets, particularly when one of the major world economies is affected. Markets react badly to negative geo-political events and different factors can be seen to influence these reactions. However, as we can see, after an initial sell-off and a period where investors try to digest events, markets tend to recover relatively quickly.

While history does not necessarily repeat itself, patterns often arise, so it is safe to assume from historical events that markets eventually recover from major shocks. Therefore it is important as investors to remain aware of geopolitical events and understand the potential impact they may have on the markets in order to avoid knee jerk reactions while investing.

Sign up here to begin your investment journey with Ndovu.

References

D’Souza, D. (2022, September 23). How War Affects the Modern Stock Market. Investopedia. https://www.investopedia.com/solving-the-war-puzzle-4780889

Post War WW2 Economic Boom. (n.d.).

https://stgpostwarboom2.weebly.com/post-war-ww2-economic-boom.html

Ro, S. (2016, February 5). Here’s the truth about the stock market in 16 charts. Business Insider. https://www.businessinsider.com/charts-that-explain-stock-market-2016-2?r=US&IR=T

C., & C. (2022, March 2). How conflicts and war affect stock markets? Chase De Vere Medical. https://chasedeveremedical.co.uk/how-conflicts-and-war-affect-stock-markets/#:~:text=As%20we%20can%20see%2C%20the,recover%20to%20its%20

Burke, C. (2022, September 22). Investing During War Times | Stock Market Performance. The Spectrum IFA Group. https://spectrum-ifa.com/investing-during-war-times/

MFSA. (2022, June 16). The Effect of War on the Financial Markets – MFSA. https://www.mfsa.mt/publication/the-effect-of-war-on-the-financial-markets/