Life in Kenya is becoming increasingly expensive. The cost of living has been rising steadily over the past few years, and it continues to strain people’s finances, with many Kenyans struggling to afford even the most basic household items. To put this into perspective, let’s look at how much deeper Kenyans have been digging into their pockets by looking at the price changes of different commodities over the year.

| Commodity Name | Price change over the last year |

| Potatoes (1kg) | +20.1% |

| Beef (1kg) | +6.6% |

| Sugar (1kg) | +22% |

| Cooking fat (500g) | +4.8% |

| Electricity (50Kw) | +63.8% |

| Petrol (1L) | +23.7% |

It is, therefore, undeniable that life in Kenya is becoming costly, so is there any hope of better days to come?

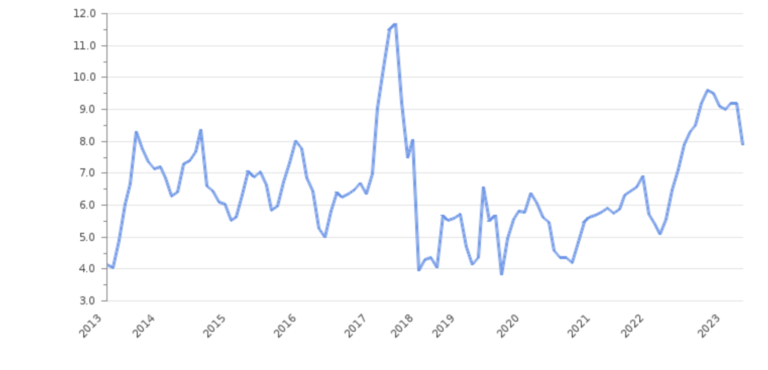

Kenya’s reported inflation rate in April 2023 was 7.9%. While this was a marked decrease from 9.2% in March, the recently reviewed fuel prices to a historic high are likely to negatively impact the cost of living experienced by the ordinary Kenyan. When fuel prices rise, the costs of energy, transportation, consumer goods, and service charges are likely to experience a similar surge. Things are, therefore, possible to get worse before they get better.

Source: Trading Economics – KENYA NATIONAL BUREAU OF STATISTICS.

So how does one navigate the rising cost of living in Kenya? While the government needs to take action to address this issue, there are steps that individual Kenyans can take to help them cope with the situation.

Managing the ever-increasing cost of living on the same salary may seem challenging, but it is not impossible. Having strategies to maintain your household budget while avoiding relying on debt is crucial. Here are some strategies that may help you cope with the situation:

- Budgeting: Create a detailed budget to track your income and expenses. Prioritize essential expenses such as housing, utilities, food, and transportation. Identify areas where you can reduce discretionary spending to free up more money for basic needs.

- Reduce unnecessary expenses: Look for ways to cut back on non-essential expenses. This could involve reducing dining out, entertainment costs, subscription services, or finding cheaper alternatives for specific products or services.

- Increase your income: Explore opportunities to increase your revenue, such as taking on additional part-time work, freelancing, or starting a side business. Utilize your skills or hobbies to generate other income streams.

- Negotiate salary or seek promotion: Consider having a conversation with your employer about a potential salary increase based on your performance and the increased cost of living. Alternatively, explore opportunities for career advancement or promotion with higher pay.

- Save and invest: Even with a tight budget, save a portion of your income regularly. Build an emergency fund to handle unexpected expenses and consider investing in long-term wealth-building options such as stocks, mutual funds, or retirement accounts. At ndovu, with as little as Ksh 200, you can safely earn returns ranging from 5.5% to 7% (ndovu estimate) with our ndovu sure Additionally, those seeking to invest can choose from a range of exchange-traded funds offered on the platform and, with as little as $50, begin their journey towards holding a diversified portfolio.

- Seek cost-saving strategies: Look for ways to save on essential expenses. This can include shopping for discounts, using coupons, comparing prices, and negotiating better deals on services such as insurance or utilities.

- Seek professional advice: If you’re struggling to manage your finances on the same salary, consider consulting with a financial advisor who can provide personalized guidance and strategies to help you navigate the situation. At ndovu, we offer a free financial planning session to help you get started. Simply send an email to support@ndovu.costating a “financial planning session.”

Remember that managing the increased cost of living requires discipline, planning, and sometimes tough choices. Prioritize your expenses, explore ways to increase your income, and be proactive in finding cost-saving opportunities.

Disclaimer: Ndovu does not offer any guarantees on returns. The quoted return reflects the fund’s past performance for the past year.

Disclosure: Ndovu is a regulated Robo-Advisory platform operated by Waanzilishi Capital Limited (‘Waanzilishi’). Waanzilishi is a fund manager licensed by the Capital Markets Authority (Kenya) and a Data Controller Registered by the Office of the Data Protection Commission.