Diversification, let’s talk about it!

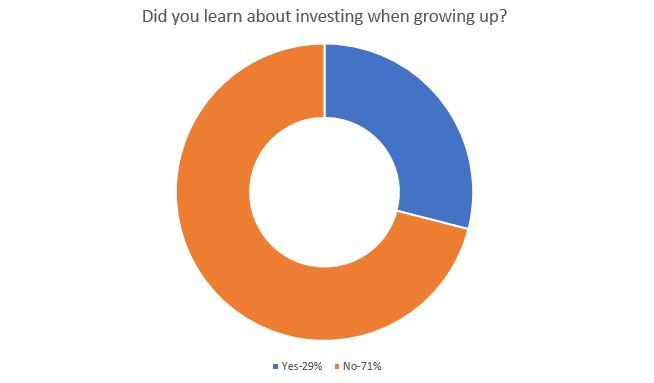

‘We were not taught about investing when growing up.’

Attendees have uttered this sentence multiple times during our monthly Ndovu Academy webinars.

A quick internal poll on this issue produced the following results:

However, when we changed the to “Are you familiar with the proverb that says, ‘Don’t put all your eggs in one basket?'”, we got the following results:

OK…Aaah…So, is this relevant to diversification?

This common proverb is arguably one of the most powerful lessons in investing. It essentially means that one should not put all resources in one area. In investing terminology, this is referred to as diversification.

Go on, tell me more….

Diversification ensures that an investor reduces the risk of losing money if an unforeseen event occurs.

Investments can be diversified (placed in different baskets) in several ways:

- By asset class (bonds, shares, ETFs)

- Sector (technology, sports, financial services)

- Geography (Kenya, USA, China)

- Currency (Kenya Shilling, US Dollar, Yen)

Over the following weeks, we shall describe each type of diversification strategy at the ndovu Academy.

How do you currently reduce risk in your investments? We are keen to hear from you. Please drop us a comment below.

Disclaimer.

The information provided on this platform and the products and services offered are intended solely for persons in regions and jurisdictions where such distribution and utilization are in accordance with local laws and regulations.

ndovu does not promote its services in regions lacking the necessary licenses; It is exclusively available to persons residing in countries with a valid license or licensed partners. ndovu does not extend its services to citizens of the United States, Canada, Japan, and other restricted territories.